Alternet Systems, Inc. (USOTC: ALYI) reported in May that it plans to bring the first electric rideshare motorcycle service to Kenya by July of 2021, expanding their portfolio of eco-friendly and powerful transportation solutions to include self-driving electric motorcycles.

The expansion comes after the finalizing of a contract for ALYI to supply Kenya with 2000 elecric motorcycles for the mototaxi ride-share industry, now opening the door to self-driving options as well. The African motorcycle ride share industry is valued at an estimated $4 billion, representing a massive potential for ALYI solutions. The July delivery schedule puts a second near-term catalyst in play.

Along with the July launch of its pilot boda boda rideshare operation, ALYI will supplement that initiative through the offering of self-drive rentals as well. The plan is to offer electric motorcycles that can be unlocked by users via a smartphone app, a format similar to the increasingly popular electric scooters that can be found in densely populated areas throughout the United States.

The excellent news is that ALYI’s latest electric motorcycle ride-sharing service is only the next step in the company’s broader plan to create an entire ecosystem of electric vehicle and maintenance solutions. Now, with multiple programs and new partnerships in place, it may be the perfect time to consider investing in ALYI stock before its upcoming developments potentially send the stock skyrocketing.

2021 Could Be ALYI’s Breakout Year

As Tesla, Inc. (NASDAQ: TSLA) continues to help the EV industry evolve, more players are entering the sector to take advantage of niche opportunities as technology becomes more accessible. Many analysts still point to Tesla as the ultimate barometer of EV industry health, and its growth has brought even more investor confidence in startups following a similar path. That’s good news for ALYI, which is no amateur when it comes to alternative energy solutions.

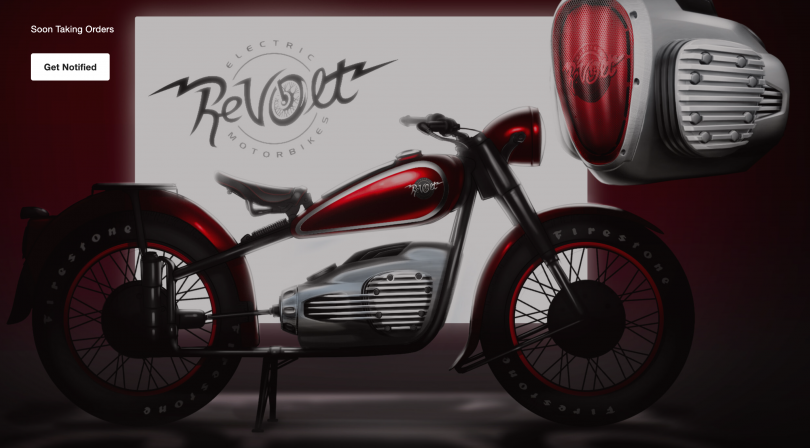

The most important aspect of ALYI for investors to note is that their portfolio goes far beyond an innovative electric motorcycle. Behind the creative design of its flagship ReVolt motorcycle is an evolving electric vehicle ecosystem that can add value and service to both domestic and international markets. Already, ALYI plans to build and benefit from an Electric Vehicle (EV) Ecosystem, which will position the company to enjoy ongoing revenues from the operations of its services, many of which can offer advantages over competing products. Further, with ALYI simultaneously exploring multiple revenue-generating opportunities, revenue growth can come sooner rather than later.

Building An EV Ecosystem Could Bring Big Results

In fact, ALYI already has multiple plans in motion that the company believes will generate substantial returns to its investors. The company introduced its EV portfolio to the world with its announcement of the ReVolt electric motorcycle, which is now part of the finalized deal involving 2000 units being sent to Kenya. ALYI believes that the motorcycle will greatly capitalize upon the enormous motorcycle taxi (boda boda) market in the area, where fuel-efficiency and mobility are a top concern for drivers. While the cost-effective solutions offered by ALYI will position them to take advantage of the risedhare opportunity, the company also plans to maximize its potential through the development of a fuller EV ecosystem that could generate sustained revenues. One of the first ways that the company plans to do so is by allowing customers to make payments through its own app.

Alongside the initial 2000 bike order in Kenya, the ReVolt electric motorcycle is expected to soon hit the United States market as well, albeit at a different capacity. Leveraging the positive response to the Africa-targeted release, ALYI has now unveiled the Retro Revolt Electric Motorcycle, which will be sold for a limited time in the United States. The limited release is intended to showcase how electric vehicles can offer a long-term and eco-friendly solution to the enormous ride-sharing industry, and the strong performance and classic look of the Retro ReVolt bike are sure to draw attention to how ALYI could provide a new wave of ride-share developments within the country.

Not to be deterred by the difficult economic conditions created by the pandemic, ALYI has prioritized a long-term sustainability model that will allow for safe and consistent growth of the company. The company has secured a funding plan that will provide more than ample time for it to finish the developments of its EV ecosystem, host its symposium in Kenya, and finalize the rollout of its ReVolt electric motorcycle.

A newly developed plan with ALYI’s financial partner RevoltTOKEN (RVLT), is expected to kickstart some of the growth for Q2 of 2021. There’s more.

Optimizing the Balance Sheet to Prepare for Long-Term Scaling

The strategic positioning and alternative finance methods by ALYI will also support the company as it scales into its larger business opportunities. Departing from its original strategy of utilizing common stock to access investment structures, ALYI has announced its new cryptocurrency approach involving RVLT. The company’s partnership with RevoltTOKEN was announced earlier in 2021, and is designed to support the expansion of its entire ecosystem of EV and related technologies. The token is currently available for anyone to purchase through a secure, encrypted, and KYC-compliant platform, and are planned to be released for exchange on additional platforms in the near future.

ALYI also shared with its investors that it completed a $1 million raise at a $0.10 price point to in order to support the expansion of its EV ecosystems into new markets, the revenues from which will better allow the company to expand its portfolio beyond simply the rideshare sector.

ALYI also reminded investors that this action is only the first of many upcoming developments that could bring sizable revenues and strengthen its balance sheet. While the sales of its electric motorcycles will provide the most immediate value, the accompanying ecosystem and business contracts will work to generate continuous profits for the company.

Another contract is also in the works, made possible by ALYI’s experience and connections with top manufacturers of innovative battery technologies.

ALYI and IQST’s Collaborations Could Open Many New Doors

One potentially lucrative agreement is with iQSTEL, Inc. (OTC: IQST). That partnership is currently working to bring a number of innovative initiatives to fruition. The first is a collaborative effort between the two firms to create revolutionary battery designs that have the potential to transform the industry. Both technologies, HD thin-film technology in one and industrial hemp in the other, are capable of producing a final product that could possibly outperform the current standard of EV battery solutions.

Other projects with IQST include building a communications system to support battery geolocation, easy maintenance, communications with law enforcement or emergency services, and remote configuration. This system could allow ALYI to capitalize on revenue-generating opportunities for through component leasing services, rideshare applications, and other services required to maintain the devices powered by its technologies. ALYI even believes that the unique benefits offered through its portfolio could become appreciated by its own competitors, creating opportunities for significant growth through contracts supplying other players in the industry.

Current Valuations Should Catch Investor Attention

At its current price, ALYI appears to be offering an attractive value proposition. Despite battling broader market weakness, even in the EV sector, the stock price remains up more than 418% in 2021. And with investor confidence in the EV industry gaining momentum as pandemic-related manufacturing delays begin to ease, ALYI’s valuation could rise quicker than many might think.

Many expect that ALYI’s valuation will rise soon following its delivery of the confirmed order of 2000 ReVolt cycles to Kenya. The bike certainly captured investor attention, even before its release – sending shares 19% higher intraday after the company released a preview video showing the innovative technologies powering the ReVolt electric motorcycle. The actual release in Kenya and later North America could send the valuation climbing even higher.

Now benefiting from a stronger balance sheet, collaborations and partnerships with other industry experts, and the Kenyan launch of the ReVolt EV motorcycle, ALYI is on track to seize its chance at becoming a breakout star in the EV and rideshare sector. As the delivery date nears, many investors believe that the current share price is neglecting the significance of 2000 electric motorcycle contract with Kenya. They further point to the value of its agreements with RevoltTOKEN and IQST as being neglected as well. With that said, the path of least resistance appears to be higher..

Thus, an investment at current levels could potentially deliver substantial returns. Moreover, with ALYI closing in on at least two near-term catalysts, the move higher could come sooner rather than later.

Disclaimers: Hawk Point Media is responsible for the production and distribution of this content. Hawk Point Media is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The information made available by Hawk Point Media is not intended to be, nor does it constitute, investment advice or recommendations. The contributors may buy and sell securities before and after any particular article, report and publication. In no event shall Hawk Point Media be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or made available by Hawk Point Media, including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Hawk Point Media was compensated three-thousand-five-hundred-dollars by wire transfer to produce research, video, email, newsletters, and editorial commentary for Alternet Systems, Inc. by a third party. Past performance is a poor indicator of future performance. The information in this video, article, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. Hawk Point Mediastrongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results.Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled.